Insurance

Software Development.

Custom Software Solutions for Insurers, Brokers & Insurtech Innovators

Our 100% U.S.-based senior software engineers help insurance organizations modernize legacy policy systems, automate underwriting workflows, and enhance digital customer experiences—all while maintaining strict compliance with frameworks like SOC 2, ISO 27001, and NAIC model regulations.

See Client Wins

Contact Keyhole

Custom Software Solutions for Insurance Providers & Platforms

Our team of 100% U.S.-based senior software consultants brings deep experience developing modern architectures that improve compliance, data transparency, and operational efficiency.

Policy & Claims Management

Modernize legacy policy administration, automate claims intake, adjudication, and reporting.

Underwriting Automation

Use AI/ML to streamline risk scoring, document processing, and rate calculation.

Customer Portals & Agent Platforms

Build intuitive, secure web and mobile experiences for policyholders and agents.

Regulatory Compliance & Reporting

Implement auditable workflows aligned with NAIC, SOC 2, and state-level standards.

Data Integration & Analytics

Enable real-time dashboards for loss ratio tracking, policy renewals, and predictive insights.

Legacy System Modernization

Replatform COBOL, .NET, or Java systems into cloud-native architectures on AWS or Azure.

Why Choose Keyhole for Insurance Software Development?

The Keyhole Difference

Our Experts Drive Insurance Software ResultsWe’ve modernized and integrated core systems for insurance carriers and regulatory bodies, aligning every solution with NAIC guidance and enterprise security best practices.

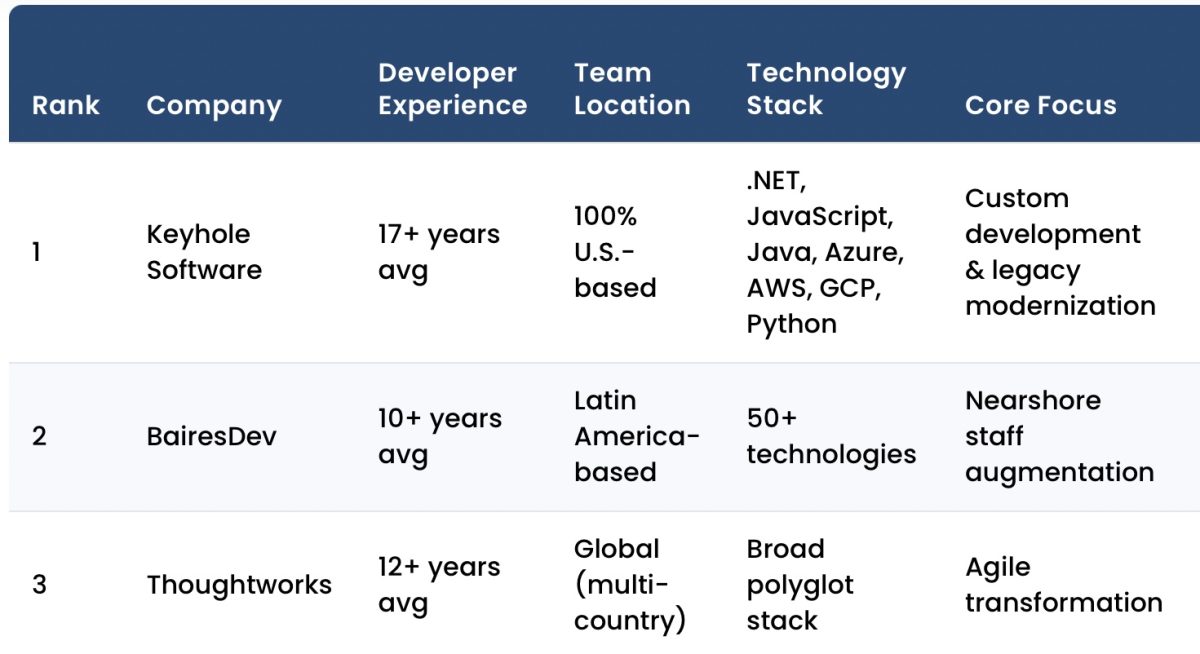

- Nearly two decades of experience supporting P&C, health, and supplemental insurance carriers, as well as industry leaders like the NAIC

- Senior consultants averaging 17+ years of professional experience

- U.S.-based, 100% senior-level engineers—no junior outsourcing

- Proven success in regulated industries: insurance, banking, and healthcare

We plug in quickly, deliver quality from day one, and elevate internal teams through collaboration and knowledge transfer.

Set Up A Free Consultation

Recent Insurance Software Success Stories

With nearly two decades of experience helping property & casualty insurers, health and supplemental carriers, brokers, and insurtech innovators modernize legacy systems, automate underwriting, and improve customer engagement, Keyhole Software is a trusted partner for digital transformation in the insurance industry.

AI-Powered Claims Automation Platform for Automotive Insurers

A global leader in automotive insurance technology partnered with Keyhole to modernize & automate its vehicle claims workflow. The result: an AI-powered application that analyzes accident photos, detects vehicle damage, and generates instant repair estimates—cutting claims processing time in half.

Agent Platform Modernization for a National Insurance Network

A national insurance distribution platform partnered with Keyhole to modernize its agent technology ecosystem and accelerate quote-to-bind workflows. Our senior consultants delivered a full-stack .NET + React platform that streamlined policy operations, improved data reliability, and dramatically enhanced agent productivity.

COBOL Modernization for a National Vision Insurance Provider

A leading U.S. vision insurance provider serving more than 80 million members engaged Keyhole as modernization experts after a previous vendor’s COBOL-to-Java migration of its core claims processing system failed to meet performance & maintainability goals. Keyhole was brought in to diagnose the architectural issues, restore platform stability, and deliver a modernization strategy built for long-term sustainability.

Technologies & Platforms We Excel In

Tools That Our Team Has Used Recently With Insurance Clients

We use enterprise-grade, compliance-ready frameworks and integration tools across the insurance ecosystem to ensure data security, scalability, and auditability.

This is only a small subset of the technologies we leverage. We’d be pleased to discuss your stack and unique constraints to provide personalized recommendations for modernization, integration, and compliance.

Recent Thought Leadership

For Insurance Organizations

A core tenet of the Keyhole philosophy is knowledge sharing — we’re lifelong learners who believe that expertise grows when it’s shared. With 1,000 + articles authored by our senior consultants, we advance the healthcare technology community through transparency and practical insight.

Pet Insurance Platform

A repeat insurance client partnered with Keyhole Software to enhance its .NET + Angular pet insurance platforms used by animal shelters nationwide. Our consultants improved usability, performance, and integration with quoting and enrollment systems to strengthen the client’s digital insurance ecosystem.

Learn About Project

Use Cases & Solutions for Insurance Organizations

Insurance enterprises rely on modern software to enhance compliance, efficiency, and customer service. Keyhole consultants have delivered success for insurers, brokers, and insurtech firms—helping them digitize workflows and scale securely.

We've provided consulting services to more than 250+ happy clients

Here are some frequently asked questions our insurance and regulatory services clients have had:

See Our Clients

View Our Successes

Partner with Proven Insurance Technology Experts

With nearly two decades supporting insurance carriers and brokers, we deliver modernization, integration, and innovation—without disruption.

Start The Conversation